The third-party insurance is mandatory for all cars, and premium gap is Bollywood for EV and Ice Car, Bollywood, oven damage components are higher for EV. Overall, absolute premiums are shot for various reasons. “This is due to high shopping prescription, which is the fact that high replacement costs, expensive special parts (especially traction batteries), high repair costs are, and there is a lack of expert repair network in EV,” says Tata AIG General Insurance and Data Sciences Officer.

Read | Buying an electric car? Before spending large money

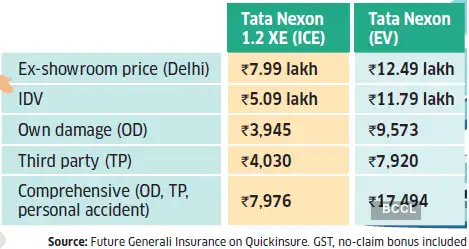

For EVS, ideologies have considered premiums that they are more than 3-2-25%, which shows quick inspection on online insurance portal such as Quikinser and Policybazar that premiums for EVC are usually 25-60% higher than ice vegetables. For example, the premium difference for the base models of Tata Nexon in the petrol and EV category is about 54% for the widespread insurance with the third party and its own damage components.

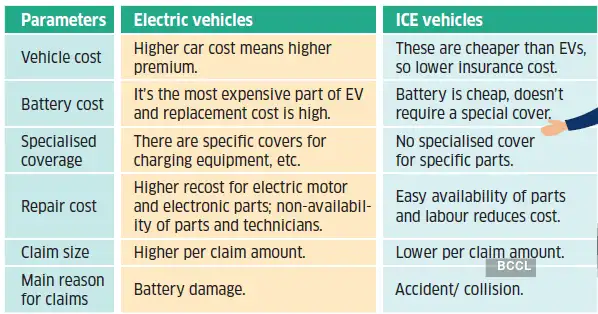

How does EV and ICC distinguish insurance for vehicles

How different is the price?

The third-party costs only at a minor, while the perfect premium shoots for EV.

Causes of EVS’s Higher Insurance Cost

Here are some of the factors that have more insurance for electric vehicles.

Purchase Price: One of the major reasons for high EV insurance is the cost of a vehicle its EVS is 12-30% more expensive than ICE vehicles. Since the market value of EVS is high, it translates to high insurers declared value (IDV), which goes to the higher premium in the tard.

Read | Low maintenance, ideal for intra-seat travel- why this EV user believes that electric cars have an expensive, but warrtic investment

Battery Price: “Changing the battery shows a huge financial burden, which is 50-70% of the total cost of most of the most important models in India,” says the motor product general Insurance Mayur Kacholia. “The cost of replacing the battery alone can go up to 7 lakhs at the capacity of the vehicle model and battery,” says Goodshew Majmor, head, head, motor distribution, Bajaj Alianz General Insuranch. Therefore, the risk of damage will lead to high premiums.

The cost of repair: “Repair costs for high-voltage batteries and motors are significantly higher in EV, EV, most original equipment manufacturers (OEM) do not offer children for these components,” Gauravrav Aurora, main replacement and property and casualty, ICICI Lombard are called underwriting and claims. Electric motors in EVS usually have a long life and requires less frequent maintenance than ice vessels, but they can be more expensive when you need,

“In addition, infrastructure for EV repairs, including the availability of service centers and special tools and equipment, is still evolving. Also, there is a relative scarcity of skilled workers in the insulation that can handle unique complications of the EV system, which can lead to long repair times and higher labor costs,” said Kacholia.

Cover features to include

Due to the advanced technology used in EVS, a comprehensive insurance policy can prevent significant financial burden. The car owned battery should be kept in mind, especially, which is not only the most serious factor of the vehicle but also the most expensive, says Mazumar. In addition, make sure the policy includes protection for mechanical and electrical breakdown coverage and digital systems.

Battery Protection and Charging Supply: Battery damage is usually the main cause of claims in Avis, mainly due to floods and floods. Kacholia says, “Claim claims causing the most frequent problems in EVS causes battery damage and loses high frequency claims of fire.”

“First and foremost, the battery coverage is needed due to the loss of the risk of accident, natural peace and malicious acts. The first and most importantly, the battery coverage is required. Supply with the vehicle, you need to ensure that you have insured portable cables and domestic charges,” Chida is called.

Zero Depreciation: Due to the advanced and expensive parts used in EVS, the referees can be very expensive, and this feature can help you to claim the amount you need to replace the part without deducting, the least, minimal costs.

Half of the road: This can help you get back to the street by using either your battery or aerving for mobile charging. Since EVS is heavy than ice vegetables, special machines are also required to wait.

Exclusively

“Over time, the depreciation refers to the normal costumes and tears of EV is not covered. Mazumdar.

“Beyond the general standard exceptions in all vehicle insurance, EV insurance may have specific exceptions to battery. Follow the OEM guidelines or if the unauthorized repair is made without pre -approval,” says Kacholia.

.